50+ california mortgage interest deduction calculator

Estimate your monthly mortgage payment. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Home Mortgage Interest Deduction Calculator

Easy 247 Online Access.

. Your average tax rate. You need to enable JavaScript to run this. Open an Account Earn 17x the National Average.

Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Ad See how much house you can afford. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Web Answer a few questions to get started. Ad Dedicated to helping retirees maintain their financial well-being. Web Mortgage Tax Savings Calculator.

Please note that if your. Divide the cost of the points paid by the full term of the loan in. Web Find out with our online calculator.

Web California Income Tax Calculator 2022-2023. Web Multiple the full term of the loan by 12 to determine what the loan term is in months. 30 x 12 360.

Web The mortgage tax savings calculator will calculate what your potential tax savings are based on the mortgage rate you will pay on your home loan and the number of points. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket.

Web Most homeowners can deduct all of their mortgage interest. How much can the mortgage tax credit give you tax savings. Web Federal changes limited the mortgage interest deduction debt maximum from 1000000 500000 for married filing separately to 750000 375000 for married filing.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

If you make 70000 a year living in California you will be taxed 11221. However higher limitations 1 million 500000 if married. See if you qualify.

Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Find out with our online calculator.

Determining Alimony In California In 2023

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

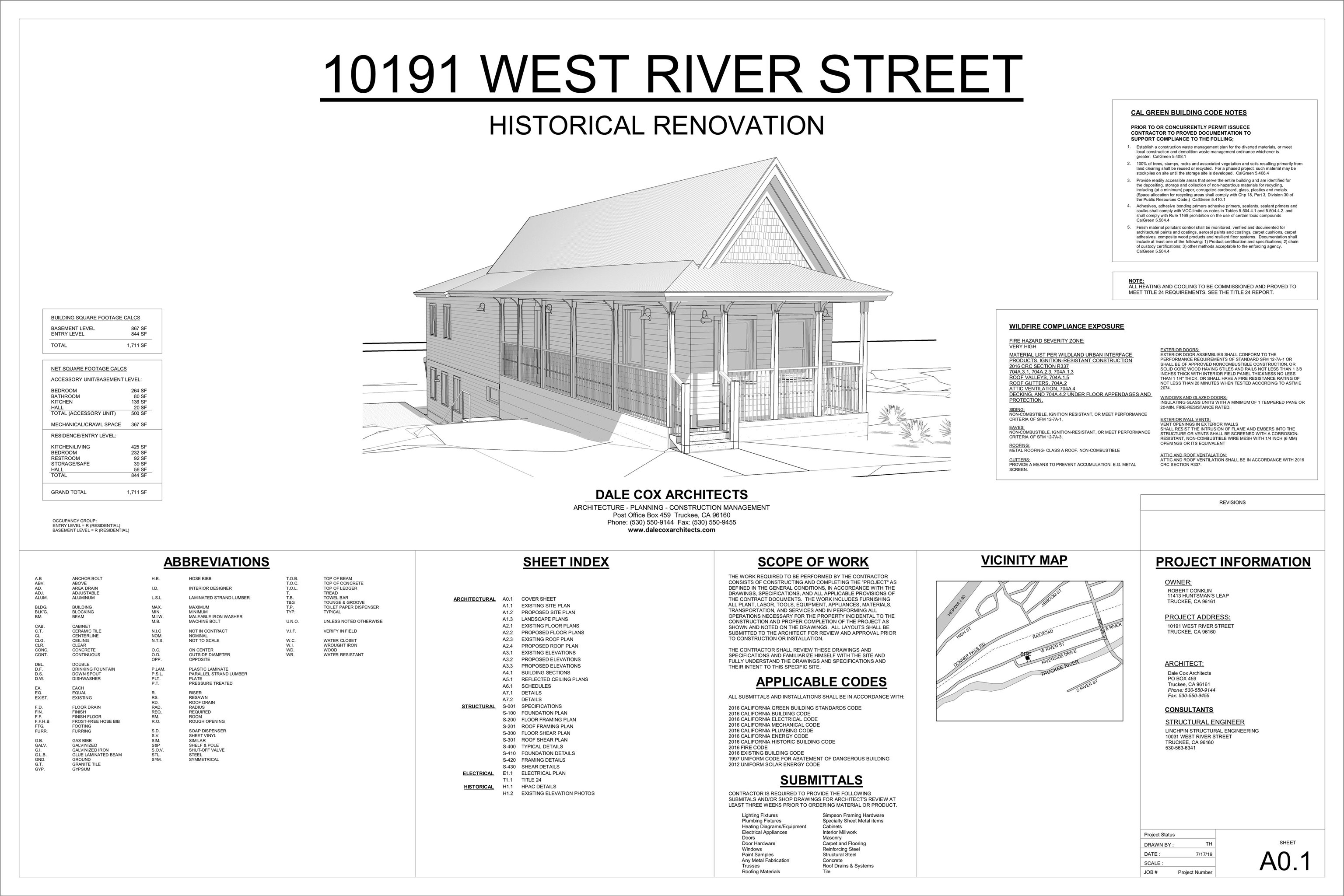

10191 West River Street Truckee Ca 96161 Compass

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction How It Calculate Tax Savings

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Gst Calculator Calculate Gst Online In India Bajaj Finserv

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

1040 Calculator Estimates Your Federal Taxes

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Gst Calculator Calculate Gst Online In India Bajaj Finserv

California Mortgage Calculator With Pmi Taxes Insurance And Hoa

Home Mortgage Loan Interest Payments Points Deduction

10 Best Calculator Apps Educationalappstore

Canadian Anti Fraud Centre Bulletin Tax Credit Scams New Brunswick Financial And Consumer Services Commission Fcnb

Term Life Insurance Rate Calculator Instantly Compare 50 Providers Jrc Insurance Group

Home Mortgage Interest Deduction Calculator